Money Management

Inflation Demystified: How Inflation Impacts Your Family’s Budget

What is inflation & Why is it important?

Are you hearing the news talk about inflation but wondering what inflation is and how inflation hurts your finances? In this article, we’ll explore what inflation is, why it’s happening, how it impacts your budget and what you can do about it.

Alright, let’s paint a picture of inflation. Ever notice that a cup of coffee at Tim Hortons used to cost a dollar but now costs $1.25? That’s what we call inflation it’s a bit like a sneaky giant who makes things cost more as time passes.

The tricky part is this: when the prices of things we buy like food, clothes, and even houses climb each year, the worth of our money shrinks. It’s as if your money is doing a disappearing act right in your wallet!

What is Happening With Inflation in Canada?

While it seems difficult to pin down what inflation is, it’s a pretty simple concept.

We measure inflation by something called theconsumerpriceindex or CPI. This index is a hypothetical basket of goods containing all of the items the average Canadian spends money on each year. Think of CPI as a shopping list of everything the average Canadian buys in a year.

Economists use this basket of goods to understand how inflation affects Canadian households annually. As of April 2023, prices were 4.4% higher than in April 2022.

If prices keep rising at this speed, your daily coffee could be more expensive than you’d think. Your $1.25 cup of coffee today could cost you $1.55 in just five years. And in ten years? You could be looking at nearly $2 for that same cup of coffee.

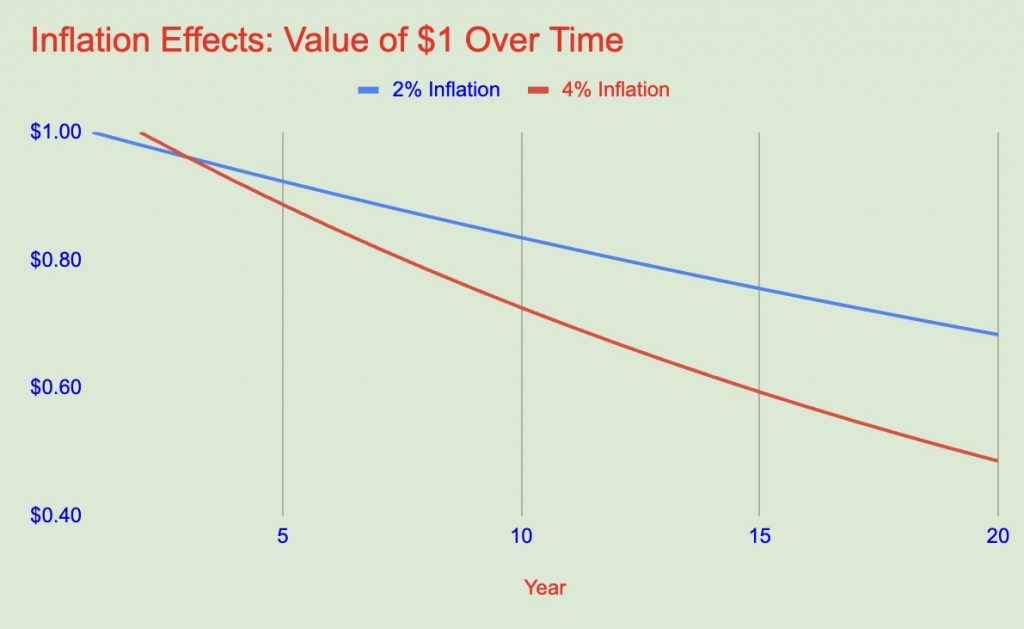

Inflation erodes buying power over time. Here is how inflation reduces the value of $1 at 2% and 4% inflation

Why is Inflation so High Right Now?

The main drivers of inflation today stem from the COVID-19 Global Pandemic. The three main drivers impacting the cost of goods today are:

- Historically low-interest rates (the cost of buying using credit)

- The logistical impact on supply chains (how we buy things and get them to our door)

- The surge in demand for a non-elastic supply of goods

To keep things simple, here is a brief explanation of these three drivers:

Low-interest rates mean lower monthly payments on debt – so you can buy more things. The result is demand for things goes up.

Global restrictions impacted supply chains – how we move goods from place to place (think: how clicking a button on Amazon results in a package on your doorstep in the morning). The result is that fewer goods reached their destinations, often taking a longer time. The result is the underlying cost of goods increases while the available supply also decreases.

Demand also surged for non-elastic (meaning a supply that doesn’t increase easily) goods. Basically, buyers bought more cars, but it takes a long time to increase the number of cars built (you can’t simply build a factory overnight).

Price is a result of supply and demand. With less supply, at a higher cost and much higher demand, prices rose for all goods very quickly. This increase in prices is the inflation we’re experiencing today.

So what does the government do to fight inflation?

The Bank of Canada sets targets for inflation with the growth of containing “runaway” inflation while maintaining a “healthy” level of inflation. For the Central Bank, this inflation target is between 2% and 3% each year.

The method the Bank of Canada uses to control inflation is through interest rates. When interest rates increase, the cost of debt increases. The result is that businesses and households spend more money servicing debt and have less money to buy other goods.

The theory is that if you have lower discretionary spending, you will purchase fewer goods, and demand decreases relative to supply. The result is that prices fall – or at least the inflation slows.

What Does Inflation Mean for Your Household Budget?

If your income doesn’t climb as quickly as inflation, you might start seeing your spare change for savings or future investments dwindling. Let’s see how inflation wreaks havoc on your monthly budget.

Imagine your total monthly bills – like mortgage, taxes, insurance, groceries, and other odds and ends – coming to $5,000. If your monthly income is $6,000 (let’s ignore taxes for now), that leaves you with an extra $1,000 every month, set aside for your retirement nest egg. Your monthly grocery bill stands at $900. But, if food prices make a 10% leap, you’re looking at a $990 grocery bill.

So, here’s the math: if your income nudges up by just 1%, your total monthly spending shoots up to $5,900. But with your income only going up to $6,600 per month, your monthly savings dwindle to $700. Over 20 years, this squeeze in savings could mean bidding goodbye to $132,428 (assuming a 6% return on investment).

And the kicker is this: it’s not only your grocery bill that’s at risk of ballooning. Nearly everything we buy, from fuel and clothes to haircuts and eating out, can become pricier because of inflation. Rising costs have a ripple effect on everything we consume.

Saving for a Rainy Day: The Effect of Inflation on Your Savings

If you dream of one day retiring and living off your savings, it’s wise to start saving early and investing those savings for growth.

Inflation sneaks up on your savings. So, a solid strategy for investing in your future is ensuring your income increases at the same pace as or faster than inflation.

Canadian’s incomes typically rise between 2% and 4% yearly. But waiting for a raise that may not come is less than ideal. Upwork.com lists almost a dozen ways to increase your income, including finding a new job, starting a side hustle or hosting a good old-fashioned yard sale.

Loans and Credit Card Bills: How Inflation Plays a Role

Another way to pad your retirement savings besides growing your income is to trim your monthly expenses. Considering the average Canadian carries $2,100 of credit card debt, a smart starting point is to pay down that debt.

Paying down $2,100 of credit card debt can increase your monthly savings by $28. Investing those savings each month results in an extra $13,738 in 20 years assuming a 6% return.

As we’ve talked about earlier, the Bank of Canada uses interest rates to control inflation. Many loans have rates that fluctuate, so the central bank’s changes affect the cost of your debt.

These changes impact loans with variable rates, such as mortgages and home equity lines of credit. If you’re carrying big balances on these types of debt, a spike in rates can eat into your savings in a big way.

Practical Ways to Navigate Inflation

Budgeting Tips for an Inflationary Period: Making Your Money Go Further

When inflation is running high, it is important to stretch each dollar further. Reviewing your budget regularly can help you navigate these challenging times.

Ensure that you reduce your expenses as much as possible to increase what you can put away into savings. Discretionary expenses such as dining out or buying new clothes and jewelry should be reduced so you have more money for essentials.

Here are a few simple tips for you to stretch your dollar further:

- Give up UBER: Walking or cycling to work, taking transit or carpooling are some ways to instantly drive down transportation costs

- Take a cooking class: Cooking more family meals rather than ordering Skip-the-Dishes not only saves money but is also a fun way to spend quality time with the ones you love

- Hunt for bargains: Growing up, my family loved going to yard sales. My favourite was finding unwanted board games in perfectly good shape. These games typically cost a fraction of what they cost in stores

- Everything has its season: Did you know that used bicycles on Kijiji cost less in November than they do in April? Why? No one (except my father) is thinking about going for a bike ride around town in November. Buying used goods is a great way to save money, but you can save even more money by timing your purchase when fewer people are buying the same item.

Personal story: The lastpoint comes from my dad’s side gig. My father buys several bicycles in the fall and spends his winter fixing them up in his garage. He often buys them for $30 – $50 and spends $20 on average to fix up each bike. He then sells each bike for $150 – $200 when spring comes around. This side gig generates a couple of thousand dollars for him per year. By the way, if you happen to see a man in his late 60s cycling the streets of Oshawa in the winter, please give him a little more room when you drive by. His kids will thank you! 🙂

Smart Savings: Understanding Interest Rates and Your Bank Account

When you stash your cash into a savings account, your bank usually pays you less than 1% interest. Sure, every Canadian needs a safety net – about three to six months of savings tucked away for rainy days. But if you’re only parking your money in a savings account, you might be shortchanging your future financial dreams.

Let’s take a peek at how interest rates can massively affect your financial future.

Here’s the scenario: You will save $1,000 per month every month for 20 years. The money can either get tucked into your savings account at 1% or you can invest in an index fund that tracks the stock market. While the index fund returns will vary each year (called risk), over 20 years you can expect to receive an average return of 9%.

Scenario 1: $1,000 per month @ 1% per year

Money deposited over 20 years: $240,000

Balance after 20 years: $265,561

Scenario 2:$1,000 per month @ 9% per year

Money deposited over 20 years: $240,000

Balance after 20 years: $667,887

*The TSX has historically averaged 9.7% return on investment per year over time. Past results do not guarantee future results. Discuss investment returns and options with your financial planner

That is a *gigantic* difference. In scenario two, you have over $400,000 more by just placing your money into a simple index fund. (By the way, Warren Buffet – the world’s savviest investor – wants his wealth invested into an index fund like his after his death. If it’s good enough for Warren, it should be good enough for the rest of us).

Let’s go back to our earlier example. Your monthly after-tax income was $6,000, with $1,000 going to savings. Your expenses would be $5,000 but will increase with inflation at 2.5% each year.

In 20 years, your monthly expenses would increase to $8,193. At this rate, your savings will deplete in:

- Scenario 1:2.74 years

- Scenario 2:10.54 years

Remember, inflation touches everything we buy, so it’s super crucial to handle your savings smartly today to ensure a comfy cushion for the future. Feeling a bit lost about how much to sock away for retirement? It might be a good idea to have a chat with a licensed financial advisor about your investment strategy.

A financial advisor is someone that can help craft an investment strategy that matches your future goals with your current financial capabilities and risk tolerance. If you don’t have a financial advisor, reach out and I’d be happy to connect you with someone amazing.

How to Keep Inflation From Impacting Your Finances

Inflation is referred to as “the cruellest tax of all”. The current inflation we are experiencing in Canada is eating away at your savings. While we have little control over inflation, we can work to control our monthly budgets and investments.

The steps that you should be taking to keep inflation from hurting your finances are:

- Cut costs in your discretionary spending.

- Ensure that you are paying down debt and reducing your interest costs. Paying interest reduces your available savings and has a seismic impact on your financial future. If you’re having difficulties with high-interest credit card debt, reach out for some free budgeting advice.

- Speak with a licensed financial advisor to ensure you’re investing your savings wisely and planning for your financial future.

About the Author

The column's goal is to level up your financial knowledge and help you avoid common pitfalls and mistakes along the way. Although money management sometimes seems like an intricate task, it doesn't have to be. The advice here is common sense and simple to follow. The first step to a better financial future starts here, and it's never too late to begin. Adam Stapley is a Mortgage Broker with Pineapple Financial and author of the personal finance Newsfeed CanadianFinanceGuide.ca. He is intensely passionate about helping Canadians build wealth through the power of real estate. Many of the articles in this column come from Adam's experience assisting Canadians to understand and shape their personal finances. Pineapple Financial Lic #12830 CanadianFinanceGuide.ca adam@canadianfinanceguide.ca