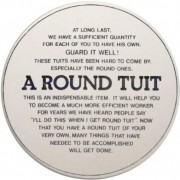

Is there an invisible employee on your team?

posted Wednesday, August 19, 2015

If you run your own business, it makes sense to hire an invisible employee who is always unseen, never comes in late, never calls in sick, never adds to your statutory deductions, will never cost you a dime in severance payments, and will repay you dollar in salary they received if you decide to terminate […]